Blog

-

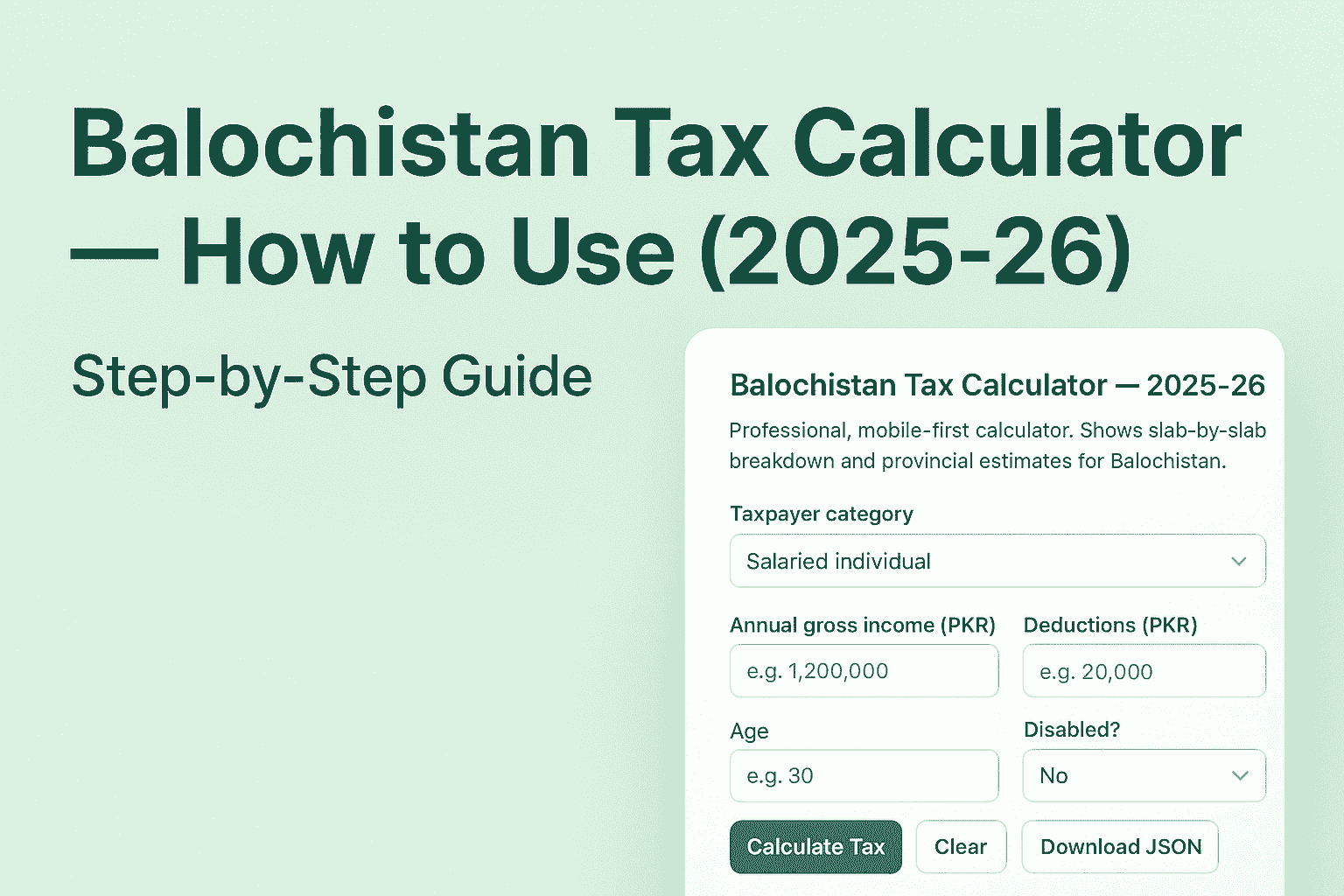

How to Use the Balochistan Tax Calculator (2025-26): Complete Guide

Managing your taxes in Balochistan just got easier! The Balochistan Tax Calculator (2025-26) is a simple, mobile-friendly tool designed to…

Read More » -

How to Use the Khyber Pakhtunkhwa Tax Calculator (2025–26)

The Khyber Pakhtunkhwa Tax Calculator (2025–26) is a smart online tool designed to help individuals and businesses in KPK, Pakistan…

Read More » -

How to Use the Sindh Tax Calculator 2025–26 (Salaried, Business & Freelancers Guide)

The Sindh Tax Calculator 2025–26 is a professional, mobile-friendly web tool designed to help individuals, business owners, and freelancers estimate…

Read More » -

How to Use the Punjab Tax Calculator 2025–26 — Complete Guide

Welcome to promza.site, your trusted platform for accurate and simple tax estimation in Pakistan.Our Punjab Tax Calculator 2025–26 helps you…

Read More »