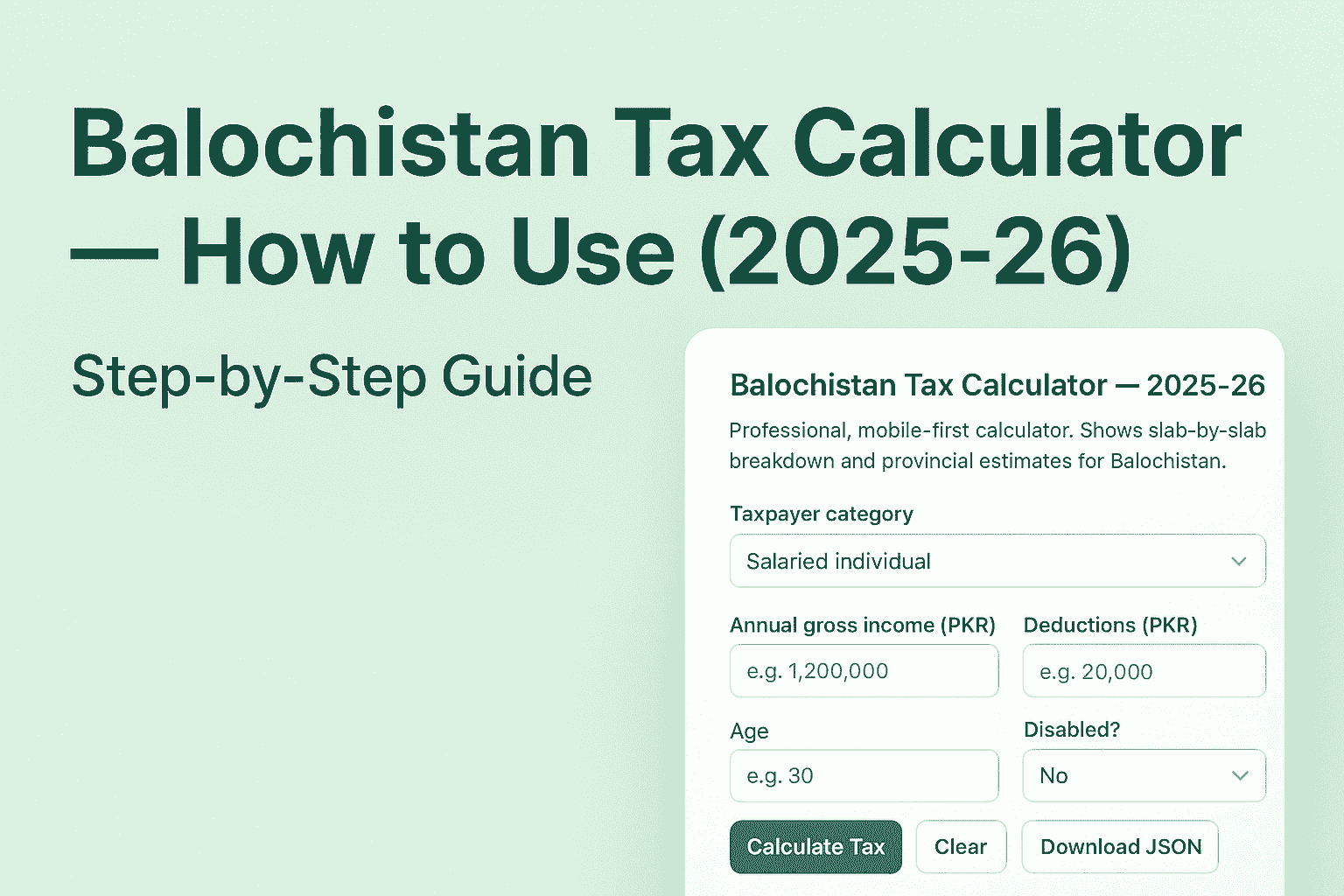

How to Use the Balochistan Tax Calculator (2025-26): Complete Guide

Managing your taxes in Balochistan just got easier! The Balochistan Tax Calculator (2025-26) is a simple, mobile-friendly tool designed to help you calculate your federal and provincial taxes in seconds. Whether you’re a salaried employee, freelancer, or business owner, this calculator provides an instant slab-by-slab breakdown based on your income, deductions, and province-specific levies.

This step-by-step guide will show you exactly how to use the calculator efficiently — even if you have zero experience with tax forms or numbers.

What Is the Balochistan Tax Calculator?

The Balochistan Tax Calculator is an online tax estimation tool that follows the 2025-26 federal and provincial tax rates. It helps you calculate:

- Federal income tax (based on FBR slabs)

- Provincial levies (Balochistan-specific)

- Surcharge and rebates (senior citizens, disabled persons)

- Total tax payable

It’s built for mobile and desktop users, ensuring smooth performance and accurate calculations for quick financial planning.

How to Use the Balochistan Tax Calculator (Step-by-Step)

Step 1: Choose Your Taxpayer Category

At the top of the tool, you’ll see a dropdown labeled “Taxpayer Category”.

Select the option that matches your income type:

- Salaried individual

- Business / Sole proprietor / AOP

- Freelancer / Self-employed

- Property / Rental income

Each category uses a different tax rate structure, so choose carefully.

Step 2: Enter Your Annual Income

In the “Annual gross income (PKR)” field, type your total yearly income before any deductions.

💡 Example: If you earn PKR 1,200,000 a year, enter 1200000.

Step 3: Add Deductions (If Any)

If you have eligible deductions (like investment rebates, donations, or allowable expenses), enter them in the “Deductions (PKR)” field.

The calculator will automatically adjust your taxable income.

Step 4: Enter Your Age

Provide your age to determine whether you qualify for senior citizen rebates (available if age ≥ 60 years).

Step 5: Choose Disability Status

Select “Yes” if you are a registered disabled taxpayer.

You’ll automatically receive a 50% rebate on total tax liability.

Step 6: Click “Calculate Tax”

Press the “Calculate Tax” button to view your complete tax breakdown.

Within seconds, you’ll see:

- Federal tax by slab

- Provincial levies (service tax or professional tax)

- Total subtotal

- Surcharge (if applicable)

- Rebates and final payable tax

Step 7: Review the Detailed Breakdown

The results section shows each calculation line by line, such as:

- Federal Tax Total

- Service Tax (for freelancers/businesses)

- Municipal Duty or Professional Tax

- Final Payable Amount

Each value is clearly formatted in PKR for transparency.

Step 8: Download Your Tax Summary

Click the “Download JSON” button to save your tax summary report.

It automatically generates a file named balochistan-tax-summary.json containing:

- Province

- Income

- Deductions

- Category

- Generated date and time

Perfect for record-keeping or sharing with your accountant.

Step 9: Clear and Recalculate (Optional)

If you want to start over, click “Clear” to reset all fields instantly.

Example Calculation

Let’s take an example for better understanding:

- Category: Salaried individual

- Annual Income: PKR 1,200,000

- Deductions: PKR 20,000

- Age: 30

- Disability: No

After clicking “Calculate Tax”, the tool will display:

- Federal tax (based on income slab)

- Provincial professional tax (Balochistan)

- Total payable tax with all adjustments

💡 Key Features of the Tool

- ✅ Fully responsive design (works on mobile & desktop)

- ✅ Supports all income categories

- ✅ Automatic rebates and surcharge detection

- ✅ Downloadable report in JSON format

- ✅ Accurate for Balochistan province

- ✅ Privacy-friendly: no data stored on servers

Disclaimer

This tool provides estimates only and is meant for educational and planning purposes.

For official filing or confirmation, always consult FBR or Balochistan Revenue Authority.

Why Use This Calculator?

Using the Balochistan Tax Calculator saves you time and confusion. It gives a transparent, instant, and detailed tax calculation that helps:

- Avoid underpayment or overpayment

- Plan better for savings and investments

- Understand provincial taxes better

Conclusion

The Balochistan Tax Calculator (2025-26) is one of the simplest and most accurate tools to estimate your taxes without hassle. Whether you’re a freelancer, employee, or business owner, this guide helps you navigate the tool efficiently and stay tax-smart for the financial year 2025-26.

👉 Try the tool now and take control of your tax planning today!