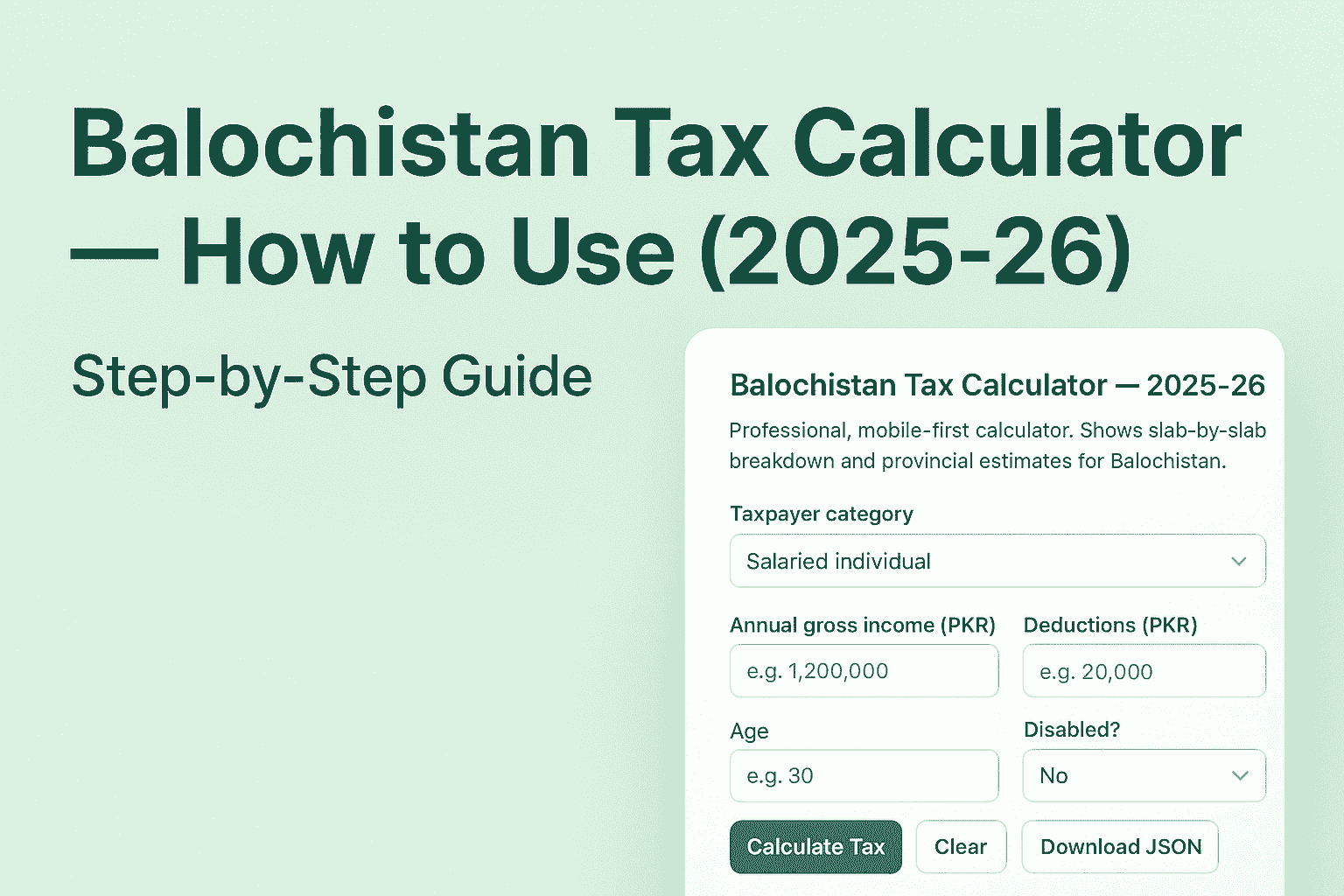

How to Use the Punjab Tax Calculator 2025–26 — Complete Guide

Welcome to promza.site, your trusted platform for accurate and simple tax estimation in Pakistan.

Our Punjab Tax Calculator 2025–26 helps you estimate how much income tax you owe based on your income, category, and deductions — fully aligned with the Federal Board of Revenue (FBR) slabs for the fiscal year 2025–26.

1. Choose Your Taxpayer Category

When you open the Punjab Tax Calculator tool, you’ll first see a dropdown labeled “Taxpayer Category.”

Select the category that matches your income source:

- Salaried Individual: For people earning a fixed monthly or annual salary.

- Business / Sole Proprietor / AOP: For small business owners, traders, or partnerships.

- Freelancer / Self-Employed: For people providing freelance services (IT, digital work, etc.).

- Property / Rental Income: For those earning rent from property or land.

Each category has its own tax brackets and provincial levies, ensuring accurate calculations.

Enter Your Annual Gross Income

In the field labeled “Annual gross income (PKR)”, enter your total yearly income before any deductions or taxes.

For example: if your salary is PKR 100,000 per month, your annual gross income is 1,200,000 PKR.

Add Deductions (If Any)

If you have allowable deductions (such as retirement fund contributions, insurance, or medical expenses), you can enter them in the “Deductions” field.

This amount will be subtracted from your gross income to calculate your taxable income.

Enter Age and Disability Status

Enter your age to check if you qualify for senior citizen tax rebates (age 60+).

If you’re registered as disabled, select “Yes” — our calculator automatically applies an additional 50% rebate to your tax payable.

Click on “Calculate Tax

After entering all your details, press the Calculate Tax button.

Within seconds, the calculator will show:

- A slab-by-slab breakdown of how your tax is calculated.

- Separate details for Federal Tax, Provincial Levies, and Rebates.

- Total payable amount at the bottom.

You’ll also see how much each percentage rate contributed to your final tax.

Review the Breakdown Section

The Detailed Tax Breakdown section shows exactly how your tax is calculated:

- Federal Slab-by-Slab: Explains how each portion of your income fits into FBR’s tax brackets.

- Provincial Levies: Includes Punjab-specific taxes like professional or service tax.

- Surcharge and Rebates: Additional charges or discounts based on income, age, or disability.

This transparent breakdown helps users understand where every rupee goes.

Download Your Tax Summary

Click the “Download JSON” button to save your complete tax report, including all slab details, in a structured JSON file.

You can use it later for record-keeping or cross-checking while filing your official FBR return.

Use “Clear” to Reset the Form

If you want to calculate for another person or try different values, press the “Clear” button.

It resets all fields instantly so you can start fresh.

Example: Tax on 1,000,000 PKR

If you enter 1,000,000 PKR as your annual income (salaried person in Punjab):

- The first 600,000 PKR is tax-free.

- The next 400,000 PKR is taxed at 1%, so your total tax is around 4,000 PKR.

This is a simplified example; actual results depend on deductions, age, and other conditions.

Why Use promza.site Punjab Tax Calculator?

- ✅ Free & Fast: 100% free with instant results.

- ✅ Accurate & Transparent: Based on official FBR tax slabs.

- ✅ All Categories Covered: Salaried, Business, Freelancer, Property.

- ✅ Responsive Design: Works smoothly on mobile and desktop.

- ✅ Privacy-Focused: No personal data is stored.

Disclaimer

The calculator on promza.site provides approximate estimates based on public tax data for Punjab (FY 2025–26).

Actual tax amounts may vary depending on FBR updates, exemptions, or individual financial situations.

Always confirm with your chartered accountant or FBR office before filing official tax returns